Find the Best THCa Hemp Flower Near Me

In the powerful landscape of hemp items, the pursuit of the finest THCa hemp flower near me can be both stimulating and intimidating. Along with the burgeoning interest in all-natural treatments and also health, the limelight has actually relied on THCa, the precursor to THC, celebrated for its own potential healing advantages without causing psychoactive effects. As the demand for high-grade THCa hemp flower climbs, navigating with the myriad of possibilities comes to be crucial. Permit’s embark on a trip to look into how to locate the best THCa hemp flower near me, ensuring superior quality and total satisfaction.

Recognizing THCa Hemp Flower: A Brief Overview

Prior to delving right into the quest for the very best THCa hemp flower, it’s important to understand the fundamentals. Unlike its own even more well-known equivalent, THC (tetrahydrocannabinol), THCa carries out not induce envigorating results. As an alternative, it accommodates talent for a variety of potential restorative advantages, consisting of anti-inflammatory, neuroprotective, and also antiemetic properties.

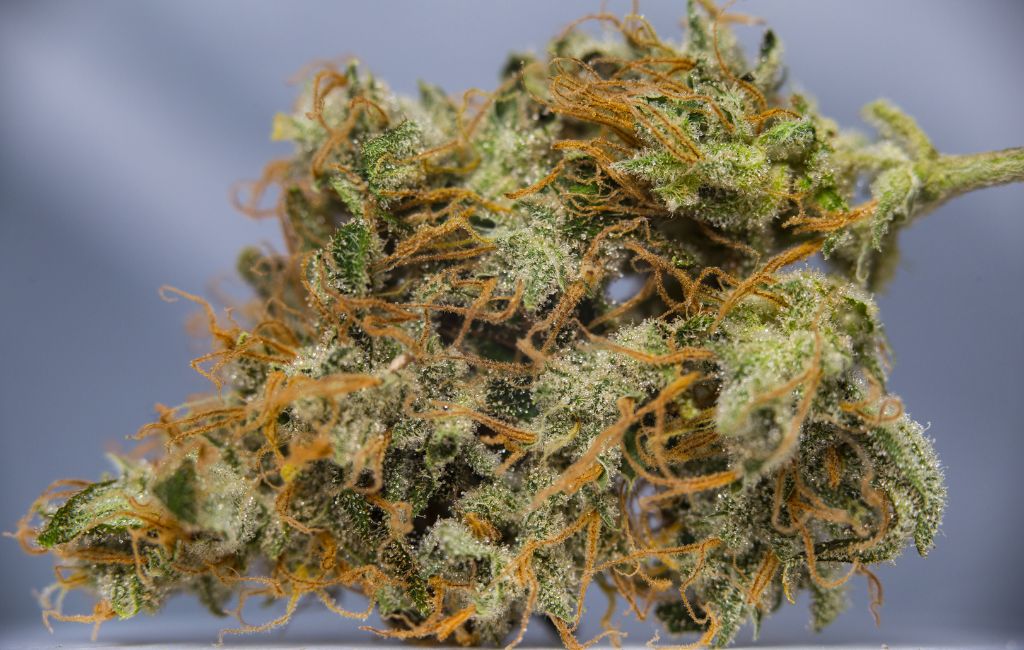

THCa hemp flower refers to the unrefined buddies of hemp plants, rich in THCa and various other cannabinoids, terpenes, and flavonoids. These substances function synergistically in what’s commonly referred to as the entourage impact, boosting the total healing capacity of the plant.

Elements to Consider When Seeking the greatest THCa Hemp Flower Near Me

- Quality Assurance: The keystone of finding fee THCa hemp flower hinges on quality assurance. Find vendors who prioritize organic farming approaches, guaranteeing that the hemp is actually devoid of chemicals, weed killers, as well as other harmful chemicals. Search for products that undergo rigorous 3rd party screening to validate potency as well as pureness.

- Stress Variety: Much like traditional cannabis, THCa hemp flower comes in a variety of stress, each boasting its one-of-a-kind profile of cannabinoids and terpenes. Experimentation along with different stress allows you to find out which ones resonate absolute best with your desires as well as intended results. Whether you’re looking for leisure, emphasis, or relief from specific disorders, exploring varied strains boosts your adventure.

- Transparency as well as Compliance: Reputable distributors maintain openness and conformity with regulative criteria. Focus on providers that deliver comprehensive info about their products, featuring growing practices, cannabinoid profiles, and laboratory examination outcomes. Compliance along with legal criteria makes sure that you’re buying THCa hemp flower coming from a reliable source, lessening possible risks.

- User Reviews as well as Recommendations: Harness the power of consumer evaluations as well as suggestions to learn insights in to the quality and also effectiveness of THCa hemp flower items. Platforms like on the internet discussion forums, social networks teams, and also assessment sites offer useful feedback coming from customers who have direct experience along with various labels. Take note of persisting styles and testimonials, assisting your decision-making process.

- Ease of access and Convenience: While the pursuit for the greatest THCa hemp flower near me hinges on high quality, availability as well as comfort also participate in crucial functions. Seek providers that offer seamless on-line buying alternatives, timely delivery services, and also responsive client assistance. Focus on providers that focus on client fulfillment and strive to enhance the overall acquiring knowledge.

Advantages of Incorporating THCa Hemp Flower into Your Wellness Routine

Combining THCa hemp flower in to your wellness program may give a myriad of prospective advantages, satisfying each bodily and also psychological well-being. A few of the notable perks include:

- All-natural Pain Relief: THCa exhibits anti-inflammatory residential or commercial properties, making it an appealing choice for easing severe ache and irritation without the adverse negative effects associated with conventional medicines.

- Anxiety and Anxiety Management: Emerging research study suggests that THCa might use anxiolytic impacts, aiding people handle anxiety, anxiety, as well as state of mind disorders. Integrating THCa hemp flower into your routine may promote leisure and a feeling of calm.

- Improved Focus as well as Clarity: Contrary to THC’s psychoactive effects, THCa is non-intoxicating, allowing individuals to experience heightened focus and also psychological clarity. Whether you’re tackling everyday activities or taking part in artistic endeavors, THCa hemp flower can easily support intellectual feature without hindering performance.

- Help for Sleep Disorders: Individuals having a hard time sleeping problems like sleeplessness might find alleviation via the calming properties of THCa. Through promoting leisure and also reducing pressure, THCa hemp flower can easily promote peaceful sleep styles, leading to improved general rest premium.

Uncovering the Potential of THCa Hemp Flower: Looking Ahead

As the yard of hemp items continues to evolve, the potential of THCa hemp flower remains enriched for exploration and development. With continuous investigation elucidating its therapeutic characteristics and also a boosting requirement for natural substitutes, the future of THCa hemp flower keeps astounding pledge.

- Developments in Cultivation Techniques: Innovations in cultivation procedures are poised to reinvent the top quality and range of THCa hemp flower pressures. From lasting farming strategies to genetic improvements, gardeners are actually continually honing their approaches to maximize cannabinoid as well as terpene profiles, enriching the overall efficacy of THCa hemp flower items.

- Appearance of Novel Delivery Methods: Beyond standard usage approaches like cigarette smoking and also vaping, the development of novel shipping methods offers fantastic possibilities for THCa hemp flower fanatics. From instilled edibles and also drinks to topicals as well as tinctures, cutting-edge solutions satisfy assorted tastes as well as lifestyles, increasing the ease of access of THCa hemp flower to a more comprehensive viewers.

- Combination with Complementary Therapies: As recognition of comprehensive health grows, the combination of THCa hemp flower with complementary treatments keeps substantial possibility. Partnerships in between professionals of conventional medicine, alternate therapies, and marijuana professionals lead the way for symbiotic strategies to health and wellness and also wellness, harnessing the advantages of THCa hemp flower along with various other techniques.

- Governing Clarity and Standardization: Clearer regulative structures and standard testing methods are actually vital for ensuring individual safety as well as assurance in the THCa hemp flower market. Continued attempts to establish suggestions for development, manufacturing, and circulation foster clarity and also obligation within the business, securing the honesty of THCa hemp flower products.

- Education And Learning and also Advocacy Initiatives: Education and also proposal efforts participate in a crucial job in destigmatizing THCa hemp flower and advertising educated usage strategies. Through disseminating accurate relevant information, encouraging dialogue, as well as advocating for plan reform, stakeholders can easily encourage people to make enlightened choices regarding THCa hemp flower and also its possible role in their wellness quest.

Conclusion

The mission for the best THCa hemp flower near you covers a multifaceted experience originated in premium, clarity, as well as efficacy. By focusing on distributors who uphold stringent standards, provide varied strain possibilities, as well as prioritize customer complete satisfaction, you can easily plunge into a transformative health trip. Whether you’re finding relief from physical distress, psychological worry, or even simply targeting to enrich your overall wellness, THCa hemp flower keeps huge pledge as an all-natural, holistic remedy. Take advantage of the energy of nature as well as embark on a quest of revelation, enhancing your lifestyle along with the myriad perks of costs THCa hemp flower.

Advantages Of THCA Flower Review

Discovering The Essence: A Beginner’s Guide To The Best Thca Flowers

Embarking on a journey into the world of THCA Flower Review could be an illuminating knowledge for amateurs and buffs as well. THCA (Tetrahydrocannabinolic acid) is actually a non-intoxicating cannabinoid discovered in raw marijuana, commemorated for its potential restorative perks. In this beginner’s overview, our company’ll examine the distinctions of THCA flowers, discovering their perks, best practices for intake, and some popular stress to look at.

In recent years, there has actually been a rise of benefit in the curative possibility of cannabinoids past the popular THC and also CBD. One such cannabinoid gaining focus is actually THCA, renowned for its own non-intoxicating residential properties and potential health perks. In this comprehensive overview, our company will definitely explore deeper right into the world of THCA, discovering its perks, procedures of usage, and distinctive pressures to take into consideration.

Recognizing THCA

THCA is a forerunner to the popular psychedelic material THC (delta-9-tetrahydrocannabinol). When cannabis is collected as well as dried, THCA progressively converts to THC by means of a procedure gotten in touch with decarboxylation, usually triggered through warmth. Unlike THC, THCA carries out not cause drunkenness, making it a desirable alternative for individuals seeking medicinal benefits without the higher.

Anti-Inflammatory: THCA has actually shown possible in lessening irritation, making it favorable for problems such as joint inflammation, inflamed digestive tract ailment, and autoimmune disorders.

Neuroprotective: Studies suggest that THCA might have neuroprotective properties, delivering possible perks for neurodegenerative health conditions like Alzheimer’s as well as Parkinson’s.

Antiemetic: THCA has been located to lessen queasiness and vomiting, making it a beneficial possibility for people undergoing radiation treatment or even experiencing intestinal issues.

Advantages Of THCA

Investigation advises that THCA might offer a range of prospective wellness advantages, featuring anti-inflammatory, neuroprotective, and antiemetic homes. Also, historical documentation proposes that THCA might help reduce signs and symptoms connected with ailments such as chronic pain, epilepsy, as well as queasiness.

Anti-Inflammatory: THCA has shown prospective in reducing inflammation, making it advantageous for ailments such as arthritis, inflamed digestive tract health condition, and also autoimmune disorders.

Neuroprotective: Studies show that THCA may possess neuroprotective buildings, delivering possible perks for neurodegenerative health conditions like Alzheimer’s and also Parkinson’s.

Antiemetic: THCA has been actually located to relieve nausea as well as vomiting, making it a useful possibility for people going through chemotherapy or even experiencing gastrointestinal issues.

Best Practices For Consumption

Eating THCA flowers calls for a somewhat various method than standard cannabis intake procedures. Considering that THCA is non-intoxicating, it’s absolute best enjoyed in its own biting type to entirely harness its own curative possibility. Here are some highly recommended techniques for eating THCA blooms:

Juicing: Juicing raw marijuana florals is actually possibly one of the most widespread approach for consuming THCA. By mixturing new marijuana buddies along with various other fruits or even vegetables, you may make a nutritious and delicious beverage packed along with THCA and various other beneficial compounds.

Smoothies: Adding raw cannabis blossoms to your beloved smoothie recipes is an additional tasty method to combine THCA into your day-to-day program. Simply blend new or frozen buds along with fruit products, vegetables, and also various other substances for a revitalizing as well as nutritious reward.

Salads: Incorporating raw cannabis florals in to salads can add a distinct spin to your food while providing a dosage of THCA. Be sure to finely cut or even grind the blossoms to improve their appearance and flavor.

Distinctive THCA Strains

When choosing THCA-rich tensions, it is actually necessary to select premium arrays along with effective cannabinoid accounts. Below are some remarkable THCA pressures to take into consideration:

Cannatonic: This hybrid pressure is actually known for its own higher THCA web content and balanced CBD-to-THC ratio, making it a well-liked option for medical individuals seeking remedy for pain, inflammation, and stress and anxiety.

Blue Dream: Blue Dream is a sativa-dominant crossbreed cherished for its uplifting effects and high THCA levels. Along with its own fruity fragrance and potent cannabinoid profile page, it is actually an excellent option for daytime make use of.

Northern Lights: Northern Lights is actually an indica-dominant stress prized for its relaxing and also sedating effects, paired with its significant THCA information. It is actually an excellent option for evening relaxation and also relief from insomnia or even persistent discomfort.

Noteworthy THCA Strains

When selecting THCA florals, it’s important to pick high-quality tensions recognized for their strength and purity. Here are actually some significant THCA stress to take into consideration:

Juicy Fruit: This sativa-dominant stress is valued for its own delightful, fruity smell and uplifting results. Along with high degrees of THCA and a balanced cannabinoid profile, Juicy Fruit is an exceptional option for amateurs as well as experienced individuals equally.

ACDC: Known for its high CBD web content and low THC, ACDC is actually a prominent choice one of health care cannabis individuals finding remedy for discomfort, inflammation, as well as stress. This crossbreed pressure offers considerable levels of THCA alongside various other useful cannabinoids.

Harlequin: Harlequin is actually a popular sativa-dominant pressure treasured for its own high THCA material and reduced THC amounts. Its own well balanced cannabinoid account as well as uplifting effects make it a best choice for daytime use.

Final Thought

Discovering the planet of THCA blooms could be a worthwhile experience for newbies interested in taking advantage of the healing potential of cannabis. By understanding the benefits of THCA, taking in finest techniques for consumption, as well as selecting high-grade strains, you can start a trip toward holistic health as well as stamina. Don’t forget to start reduced and also go slow, enabling yourself to discover the one-of-a-kind results of THCA at your own pace.

As our understanding of cannabinoids remains to progress, THCA becomes an appealing player in the arena of therapeutic cannabis. By exploring its potential perks, trying out different usage procedures, as well as choosing high quality tensions, people can easily open the healing electrical power of THCA to improve their wellness and also health. Bear in mind to speak with a healthcare professional before integrating THCA right into your health program, specifically if you possess rooting medical disorders or are actually taking medications.

THCa Hemp Flower, Legality, and Effects

In the ever-evolving garden of hemp and also cannabis products, one phrase that has actually been acquiring attention is “THCa hemp flower.” As buyers come to be much more discerning about the items they utilize, comprehending the intricacies of THCa hemp flower, its own validity, and also its effects ends up being vital. Allow’s delve into this based on solve the complexities and also shed light on what THCa hemp flower really includes.

What is actually THCa Hemp Flower?

THCa, or even tetrahydrocannabinolic acid, is actually a forerunner to THC (tetrahydrocannabinol), the psychoactive material found in marijuana. Unlike THC, THCa carries out certainly not cause psychoactive effects. Instead, it is understood for its possible curative residential or commercial properties, including anti-inflammatory as well as neuroprotective effects. THCa hemp flower describes the buddies of the hemp plant which contain extreme levels of THCa as well as minimal THC.

Legitimacy of THCa Hemp Flower

The validity of THCa hemp flower can be a gray area, largely because of the varying rules surrounding hemp and marijuana items. In lots of regions, hemp-derived items with less than 0.3% THC are actually considered legal under federal law. Having said that, the legal condition of THCa hemp flower may differ coming from area to area and also country to nation.

It’s necessary for customers to study as well as know the rules regulating THCa hemp flower in their locale. Some areas may possess rigorous regulations pertaining to THC information, while others might have much more lenient plans. Furthermore, it’s important to obtain THCa hemp flower coming from credible resources that observe all suitable rules and also rules.

Results of THCa Hemp Flower

While research on THCa particularly is still in its own beginning, preliminary studies suggest that it might deliver a variety of possible benefits. Additionally, THCa has actually revealed talent in preclinical researches for its neuroprotective effects, suggesting potential uses in the therapy of neurodegenerative diseases like Alzheimer’s and also Parkinson’s.

It’s essential to note that personal knowledge with THCa hemp flower might vary. Aspects such as dose, method of usage, as well as private physiology can all influence the impacts experienced. Some users might mention feelings of leisure as well as relief from symptoms, while others may discover no considerable results.

Getting through the Market

As rate of interest in THCa hemp flower develops, thus performs the market for these products. Consumers are actually confronted with a plethora of options, varying coming from raw flower buds to instilled items like oils as well as casts. When browsing the market place for THCa hemp flower, it’s necessary to focus on quality as well as safety.

Look for items that have actually undergone 3rd party screening to validate their cannabinoid material as well as ensure they are devoid of impurities including chemicals as well as heavy metals. Furthermore, take into consideration the image of the supplier as well as read through customer reviews from other consumers to assess the high quality of the item.

The Future of THCa Hemp Flower

As investigation in to the healing capacity of cannabinoids remains to increase, THCa hemp flower is most likely to stay a subject of enthusiasm. While current documentation proposes appealing benefits, additional research study is required to entirely comprehend the systems of action and also possible applications of THCa.

In the meantime, individuals can inform themselves on the lawful garden neighboring THCa hemp flower in their region and also make updated selections when buying and using these items. Through remaining notified and also advocating for responsible regulation, our team may make sure that THCa hemp flower continues to be accessible to those who may gain from its possible curative residential or commercial properties.

Possible Risks and also Considerations

While THCa hemp flower holds talent as a therapeutic substance, it is actually necessary to recognize that there may be actually potential dangers and also considerations linked with its own usage. One primary worry is the lack of control as well as regimentation in the development of hemp-derived products. Without meticulous quality assurance procedures in location, there is a threat of irregularity in cannabinoid web content and also the existence of impurities.

Furthermore, while THCa itself is non-psychoactive, there is the possibility of track volumes of THC appearing in hemp flower items. This is specifically important for individuals who might go through drug testing, as even percentages of THC might result in a positive test end result.

Another consideration is actually the capacity for interactions with other drugs or health and wellness disorders. As with any kind of supplement or natural remedy, it is actually essential to talk to a health care specialist prior to combining THCa hemp flower in to your health regimen, particularly if you are taking other medicines or have rooting health and wellness issues.

The Importance of Education and Advocacy

As rate of interest in THCa hemp flower remains to expand, so does the requirement for education and learning as well as advocacy surrounding its own use. Individuals ought to take an active task in promoting for liable policy and access to premium, risk-free products. This consists of sustaining initiatives that advertise investigation right into the restorative possibility of cannabinoids and recommending for reasonable marijuana plans at the regional, condition, and federal levels.

Furthermore, learning is actually crucial to resolving fallacies and also false information neighboring THCa hemp flower and also cannabis items generally. Through encouraging open and straightforward chats regarding the potential benefits and risks, we can easily inspire individuals to create knowledgeable choices regarding their health and wellness and well-being.

Arising Trends and Innovations

Aside from its own possible curative perks, THCa hemp flower is actually likewise at the cutting edge of innovation within the marijuana field. As consumer demand for alternative shipment approaches and item layouts increases, makers are actually discovering brand new ways to include THCa right into a range of products.

One arising pattern is actually the progression of THCa-infused edibles and refreshments. By incorporating THCa in to food and also beverage items, makers can offer customers a subtle and also convenient means to consume cannabinoids without the requirement for breathing. This can be especially interesting people who might feel to the violence of smoking or even choose a much more very discreet approach of intake.

One more place of development is the progression of THCa concentrates as well as draws out. Through segregating as well as purifying THCa from hemp flower, manufacturers can easily generate extremely strong products along with accurate application abilities. These focuses may at that point be used to create an assortment of products, consisting of vape containers, tinctures, and topicals, delivering buyers a diverse variety of alternatives to fit their private inclinations and also needs.

Final Thought

On the planet of hemp and also marijuana products, THCa hemp flower sticks out for its potential therapeutic benefits and also one-of-a-kind properties. Understanding the validity, results, as well as market landscape encompassing THCa hemp flower is necessary for customers that find to include these products in to their well-being schedule.

As analysis progresses and requirements advance, THCa hemp flower is very likely to continue gathering attention from each individuals and also analysts as well. By staying educated as well as focusing on top quality as well as security, individuals may get through the complex globe of THCa hemp flower with self-confidence, uncovering its own potential benefits for their wellness and also well-being.

Should You Transfer 401k to Silver? Exploring the Potential Benefits of 401k to Silver Transfer for Retirement

In the arena of retirement preparing, individuals frequently seek ways to expand their expenditure portfolios to guard their monetary future. One appealing alternative that has gotten interest is actually the transmission of 401k funds to silver. This article looks into the considerations and also potential benefits of transfer 401k to silver, attending to vital aspects that can influence your retirement method.

Knowing the Basics of 401k to Silver Transfer:

Transmitting your 401k to silver involves turning a section or even the whole of your retirement savings, commonly purchased standard possessions like assets as well as bonds, in to physical silver. This relocation is actually driven due to the wish to incorporate a rare-earth element to the mix, launching a different amount of surveillance and also potential for development.

Variation as a Retirement Strategy:

Transforming your retirement life portfolio is actually a strong strategy to relieve threat. Rare-earth elements, including silver, have actually in the past exhibited a low connection along with traditional properties, producing all of them an eye-catching alternative for diversity. Through integrating silver into your 401k, you intend to make a much more tough portfolio that can survive market changes.

Dodging Against Inflation:

Silver is actually frequently looked at a hedge against rising cost of living. Unlike fiat unit of currencies that could be based on devaluation, gold and silvers have intrinsic value. Silver, specifically, possesses industrial usages along with being actually a gold and silver, offering it along with a dual-purpose conveniences that can likely shield your purchasing power during inflationary periods.

Market Volatility and also Safe-Haven Assets:

Economic uncertainties as well as market volatility are belonging to the financial yard. Silver is usually deemed a safe-haven possession, indicating it usually tends to preserve or even increase in value in the course of times of economic turbulence. Combining silver right into your 401k may serve as a stream, giving stability when other possessions are actually experiencing downturns.

Income Tax Implications of 401k to Silver Transfer:

Just before making any selections, it is actually important to understand the income tax implications associated with transferring your 401k to silver. Depending on the approach selected for the transmission, there may be actually tax consequences. Appointment with an economic consultant is actually recommended to browse the intricacies as well as make sure conformity along with income tax guidelines.

Long-Term Growth Potential:

Silver, like gold, possesses the potential for lasting development. While it may not generate gains as high as some riskier assets, the stability and also progressive appreciation of precious metals can easily contribute favorably to the total functionality of your retired life profile.

Potential Drawbacks and also Risks:

While silver delivers diversity and a bush versus inflation, it is actually necessary to acknowledge the prospective downsides. Precious metals can be subject to cost dryness, as well as their market efficiency might certainly not constantly align with various other possession courses. In addition, storing costs as well as the requirement for safe and secure storage space locations should be actually looked at.

Consulting a Financial Advisor:

Given the complexities involved in moving 401k funds to silver, seeking specialist recommendations is actually important. A skilled financial specialist can assess your individual monetary targets, risk resistance, and the total appropriateness of a 401k to silver move based upon your one-of-a-kind instances.

Alternative Strategies and also Considerations:

It’s essential to identify that moving 401k funds to silver is actually merely some of lots of potential methods for retirement life planning. Relying on your monetary goals, risk resistance, and time horizon, alternative investments and techniques might be preferable. Look at discovering numerous options, like property, connects, or even diversified mutual funds, to produce a detailed retirement life method.

Monitoring as well as Periodic Reassessment:

Economic markets and economical ailments develop eventually. Consequently, it’s vital to routinely monitor the efficiency of your retirement life portfolio and also reassess your financial investment strategy as needed. Periodic assessments with your monetary consultant may assist make sure that your possession allotment lines up with your developing goals as well as market aspects.

Teaching Yourself on Precious Metals:

Just before making a decision to transfer 401k funds to silver, put in the time to teach yourself concerning metals and also the variables affecting their prices. Comprehending the marketplace essentials, source and also demand characteristics, and also geopolitical effects can encourage you to make knowledgeable decisions concerning the allotment of your retirement savings.

Stabilizing Risk and Reward:

Every assets decision entails a compromise in between risk and perks. While silver can offer diversity as well as potential hedging perks, it is actually critical to assess whether the involved dangers line up with your threat endurance. Hitting the correct equilibrium in between risk as well as reward is actually crucial to crafting a retired life method that lines up along with your monetary goals.

Thinking About Short-Term and also Long-Term Needs:

Your choice to transmit 401k funds to silver need to additionally think about your short-term and also long-term economic necessities. If you foresee needing access to funds in the near future, a very fluid financial investment could be better. Alternatively, if you possess a longer time perspective, the illiquidity of specific expenditures, like bodily silver, might be much more controllable.

Keeping Informed about Regulatory Changes:

Financial rules and income tax rules can undergo changes that may influence the usefulness as well as income tax ramifications of transmitting 401k funds to silver. Keep updated concerning any sort of regulative switches and be actually readied to adjust your retired life tactic appropriately. Consulting along with an income tax professional may aid you get through any sort of modifications in the legal yard.

Real-Life Case Studies as well as Success Stories:

Exploring real-life case history as well as results accounts of people who have successfully diversified their retirement life profiles through transferring 401k funds to silver can easily offer beneficial knowledge. Pick up from the expertises of others, bearing in mind of the challenges they experienced and also the advantages they received coming from such a key step.

Building a Comprehensive Retirement Portfolio:

Instead of viewing the decision to transfer 401k funds to silver in isolation, consider it as an element of a wider retirement life collection. A well-diversified profile might include a mix of possessions like equities, connects, real property, and also precious metals. This strategy can easily offer a much more balanced and tough approach that conforms to varying market states.

Long-Term Storage and also Security Considerations:

When transmitting 401k funds to physical silver, it is actually essential to take care of storage as well as security issues. Unlike digital properties, silver requires bodily storing, which may entail extra expenses. Research study trusted storing locations as well as assess their surveillance assesses to make sure the security of your gold and silvers throughout your retirement.

Market Trends and Silver’s Historical Performance:

Studying historical market patterns and also the efficiency of silver as time go on may use important insights in to its possible part in your retirement collection. Knowing just how silver has behaved in the course of different economic scenarios as well as market cycles can easily aid in helping make updated choices about its own introduction in your investment tactic.

Dynamic Nature of the Precious Metals Market:

The precious metals market is actually dynamic as well as determined through different aspects like geopolitical celebrations, international economic conditions, and industrial demand. Holiday attuned to these dynamics and also be readied to adapt your assets approach accordingly. On a regular basis upgrading your knowledge regarding the gold and silvers market is crucial for creating educated decisions.

Psychology of Investing in Precious Metals:

The decision to move 401k funds to silver is not just a financial one but also entails recognizing the psychological science of investing. Gold and silvers, typically considered positive as well as long-lasting assets, can easily stir up a complacency. Acknowledge the mental parts of your assets selections and also ensure they line up with your total financial goals.

Prospective Liquidity Challenges:

While silver uses security and also a bush against inflation, it’s crucial to acknowledge that specific metal expenditures can easily be without liquidity reviewed to more conventional resources. Evaluate your assets requirements and think about sustaining a harmony that permits you to gain access to funds when required, especially in unforeseen circumstances.

Rebalancing Strategies:

Executing a positive rebalancing strategy is actually critical when combining silver right into your retirement life profile. Occasionally reassess your possession allotment and rebalance your holdings to guarantee they align with your lasting financial objectives. This strategy helps keep the desired risk-return profile page, particularly as market disorders develop.

Verdict:

Finally, the choice to transmit your 401k to silver must be knowledgeable as well as straightened with your total retirement technique. While the possible benefits, including diversification as well as hedging versus rising cost of living, are actually desirable, it’s crucial to weigh the risks and speak with economists to create the most effective choice for your monetary future. The landscape of retirement life preparation varies, and comprehending the function of silver in your portfolio is actually a key step towards attaining a protected and tough retirement life.

A Comprehensive Review Of The Top Gold IRA Companies In The Industry

Investing in gold IRA companies is among one of the most reliable methods to expand your profile and hedge versus rising cost of living, currency decrease, and also economic uncertainty.

To assist you find the ideal precious metals IRA, we’ve assessed the best gold IRA firms in the industry. Each gold IRA firm listed below was examined on a range of elements including reputation, costs, experience, option of rare-earth elements and user testimonials on reliable sites like BBB, Trustlink, Trustpilot as well as extra.

What is a gold IRA?

Economic uncertainty has actually driven even more individuals to look for financial safety and security with diversified financial investments. Standard investment automobiles such as supplies, mutual funds, or bonds count greatly on the strength of the overall economy, leaving capitalists vulnerable to inflation as well as market volatility.

Precious metals use a compelling alternate financial investment chance. By diversifying a section of their portfolio with rare-earth elements, investors can hedge versus the risks of money decrease, inflation, and broader financial uncertainty.

A gold IRA is a kind of Individual Retirement Account in which account holders can have physical gold as a financial investment. Unlike a typical IRA where funds are purchased stocks, bonds, or other protections, the key advantage of a gold IRA is that account owners can hold tangible gold possessions. Or else, gold IRAs go through the very same tax benefits, constraints, and withdrawal charges as traditional IRAs. However, the Internal Revenue Service does mandate that gold IRA proprietors deal with a custodian to make certain governing compliance relating to the coverage, storage, as well as sorts of precious metals enabled within the account. As a result, it is vital that financiers research gold IRA business to pick a reliable custodian for their retirement assets.

How does a gold IRA work?

A gold IRA features in a way similar to a conventional IRA. A custodian company provides the account as well as takes care of all facets from purchasing to storing the gold according to the account owner’s directions. The only difference in between a gold IRA and a standard IRA is that physical precious metals constitute the invested possessions in a gold IRA. While subtle distinctions exist based on the particular gold IRA business selected, the general procedure for a gold IRA consists of the adhering to steps:

-Opening up an account (browse through our most trusted companion).

-Rolling over an existing IRA or 401( k) right into a self-directed IRA.

-Getting IRA-eligible rare-earth elements (normally gold or silver).

-Selecting a storage option.

-Storing the rare-earth elements.

-Gold IRA Rollover.

most businesses that provide self-directed precious metals Account holders of Individual Retirement Accounts (IRAs) may move their current assets in retired life insurance to a precious metals IRA. This process of transfer from a standard IRA to a rare-earth elements IRA is known either as a “rollover” or a “transfer” depending upon the specifics of the deal. Account holders should be aware of the distinctions between a rollover and a transfer of a precious metals IRA before beginning either procedure.

A rare-earth elements IRA transfer includes the partial movement of properties from a standard pension to a self-directed precious metals IRA account. On the other hand, a rare-earth elements IRA rollover entails the overall motion of all possessions from a conventional pension to a self-directed precious metals IRA account.

Due to the fact that a precious metals IRA transfer has less restrictions and penalties than a precious metals IRA rollover, it is essential to carefully distinguish between the two.

For example, precious metals IRA rollovers undergo a 60-day regulation, a 10% withdrawal fine for account owners under 59.5 years of age, as well as a yearly limit of one rollover annually. Offered these complications, account holders ought to get in touch with a tax obligation advisor prior to devoting to either a transfer or rollover of retired life assets right into a rare-earth elements IRA.

Regardless of whether an account owner selects a transfer or rollover, the motion of funds from a conventional pension to a rare-earth elements IRA need to be executed through a trustee or depository. A reputable and compliant rare-earth elements IRA provider will make sure that all rollover and transfer procedures are appropriately handled and that the resulting self-directed precious metals IRA continues to adhere to governing regulations.

A reliable and compliant rare-earth elements IRA provider will properly handle the rollover and transfer processes and ensure that the resulting self-directed precious metals IRA continues to comply with regulatory requirements.

How does a 401( k) to gold IRA rollover work?

The procedure of transferring funds from a 401( k) account to a gold IRA complies with a basic collection of actions. To start, one need to transform their routine IRA to a self-directed IRA, which allows a bigger series of investment alternatives, consisting of rare-earth elements. Second, the account owner get in touches with their favored rare-earth elements IRA firm to officially initiate the transfer of funds. At this point, the documents is completed by both parties, and also the business, functioning as the trustee, manages the staying steps. While the basic procedure corresponds, minor variants might exist between companies and also depositories, so it is prudent to verify the details with one’s chosen provider in advance. Provided appropriate regulations are followed properly, the transfer ought to be completed without issue, as well as the balances in the pertinent accounts need to be equivalent or absolutely no upon final thought.

FeatureExploring The Best Gold IRA Options

MySanantonio Best Gold Ira has actually long been an attractive choice for investors, and the appeal is rooted, partially, in gold’s historical performance history of keeping its worth in the middle of periods of high rising cost of living. However gold’s benefits prolong well past it acting as a hedge against inflation; it is also a substantial asset that gives investors with an one-of-a-kind sense of security that the majority of various other possessions can not match.

That’s a large part of why an expanding number of investors are taking into consideration including gold to their financial investment profiles. However the options for gold financial investment assets prolong past physical gold, such as bars and coins, and consist of choices like exchange-traded funds (ETFs) and gold mining stocks, along with gold-related retired life options, like gold Individual retirement accounts.

If you’re considering a gold individual retirement account, you may question just how to identify the most credible gold IRA companies. To assist, we have actually researched various gold individual retirement account companies and have assembled a list below of leading business in various classifications.

Just how to choose a gold individual retirement account

Identifying what types of items you intend to buy is a great beginning location as not all websites will use every sort of IRA-approved precious metals. While gold coins and bars are a preferred option, it’s also important to keep in mind that storage prices will be higher with physical gold in addition to other physical metal financial investments.

It’s additionally essential to consider your objectives for this investment. Are you looking for long-lasting growth, or are you aiming for short-term security from rising and fall markets? This will certainly not only affect your decision on how much you are intending to spend, yet where and what you’re purchasing too.

What makes a gold IRA various than a traditional individual retirement account?

Spending specifically in a gold IRA account can help you better prepare yourself for retired life while likewise being able to invest your money right into rare-earth elements. Gold IRAs adhere to the very same payment limits as traditional Individual retirement accounts, $7,000 for 2024, or, if you’re 50 or older, $8,000. That being claimed, gold Individual retirement accounts do feature several of their very own regulations and laws around what types of gold can belong in your individual retirement account among various other demands.

Under the precious metals IRA regulations, you must collaborate with a custodian– a financial institution responsible for the possessions in your gold IRA. Furthermore, there are a couple of other terms, such as that the rare-earth elements need to likewise have a specific purity requirement, be generated by an authorized refinery and remain in their original packaging.

Gold IRAs are often referred to as “rare-earth element” Individual retirement accounts also due to the fact that you can possess greater than gold; you can purchase gold, silver, platinum along with palladium. Not every precious metal individual retirement account supplier is going to offer the same variety of metals, which is an important factor to consider when spending.

Various other sorts of IRAs to consider

There are a few various other really usual kinds of IRAs, with the most common being a typical individual retirement account or a Roth IRA. While they will not let you straight purchase physical rare-earth elements, depending upon your demands, they could work as well.

Traditional IRA

enables you to postpone your taxes on any contributions made to your IRA account until you withdraw the cash down the line This kind of IRA is commonly most effective if you prepare for being in a lower tax bracket when you retire, therefore paying less when you withdraw the cash than you would certainly have in the past along with gaining from any type of rate of interest obtained.

A Roth IRA

Operates in a comparable method but rather than waiting to pay taxes on withdrawals, you pay tax upfront and not in the future when you take out the money. These are often much more efficient for individuals that are more youthful in their jobs and in a lower tax brace presently, after that when they end up making significantly extra in the direction of the end of their occupation, they aren’t paying their present tax obligation price on the money they get.

Both of these IRA alternatives allow you to invest in gold and various other steels, however just not physically. You can purchase gold supplies and ETFs as well as the supplies of gold mining or processing business. While often this is substantially easier than the process of purchasing physical gold, you don’t necessarily get the benefits people are looking for from physical gold such as the integral intrinsic worth as well as the security from financial slumps.

What does a gold IRA do?

A gold individual retirement account acts really in a similar way to a traditional IRA account however permits the private to buy gold and various other steels as opposed to simply extra common possessions such as stocks or bonds.

Can I acquire physical gold for my individual retirement account?

It is possible to get physical gold coins and bars for your individual retirement account gave they satisfy the internal revenue service criterion for rare-earth elements. Additionally, it is extremely suggested by the internal revenue service that you do not store your gold at home with numerous intricate legislations to enforce this treatment.

What are the demands for metals in a retirement account?

Considering that rare-earth elements are thought about antiques, they should fulfill special needs to be admitted IRA accounts. You can purchase IRA-approved gold bullion coins and bars with a fineness of.995 or higher, including American Eagles and various other select coins. Other rare-earth elements also have minimal purity needs as well.

Is a gold IRA tax-free?

A gold IRA adheres to similar guidelines and guidelines to a standard individual retirement account including not being taxed when you contribute, and being taxed when you take a distribution consisting of the 10% penalty if withdrawn prior to 59 and one fifty percent years old.

Conclusion

A gold individual retirement account is a great choice for those that wish to be able to own physical precious metals as part of their retirement. Rare-earth elements Individual retirement accounts have numerous first purchase needs in addition to various other costs and purchasing choices, so it is essential to select the one with the choices that fit your requirements the very best.

The Gold IRA Company Directory: Your Guide to Finding the Best Company for You

A gold IRA company is a financial institution that specializes in helping investors set up and manage gold IRAs. Gold IRAs are individual retirement accounts (IRAs) that allow investors to hold physical gold coins and bars.

How to Choose a Gold IRA Company

When choosing a gold IRA companies, it is important to consider the following factors:

- Reputation: Choose a company with a good reputation and a track record of providing excellent customer service. You can read online reviews and check with the Better Business Bureau to get an idea of a company’s reputation.

- Fees: Compare the fees charged by different companies before you choose one. Gold IRA companies typically charge setup fees, annual fees, and transaction fees. It is important to understand all of the fees associated with opening and maintaining a gold IRA account before you choose a company.

- Selection of gold products: Make sure that the company offers the gold products that you want to invest in. Gold IRA companies typically offer a variety of gold coins and bars, as well as other precious metals, such as silver, platinum, and palladium.

- Storage options: Make sure that the company offers secure storage options for your gold. Gold IRA companies typically store gold in their own vaults or in third-party depositories.

- Investment advice: If you are looking for investment advice, choose a company that has experienced investment advisors. Gold IRA companies typically offer investment advice, but it is important to note that they are not registered investment advisors.

Some of the most popular gold IRA companies include:

- American Precious Metals Exchange (APMEX)

- Goldco

- American Hartford Gold

- Birch Gold Group

- Noble Gold

- SD Bullion

- JMB Bullion

How to Set Up a Gold IRA with a Gold IRA Company

To set up a gold IRA with a gold IRA company, you will need to:

- Choose a gold IRA company.

- Open a gold IRA account with your chosen company.

- Fund your account with cash or transfer funds from an existing IRA.

- Choose the gold coins or bars that you want to purchase.

- Your custodian will purchase the gold on your behalf and store it in a secure vault.

Benefits of Investing in a Gold IRA with a Gold IRA Company

There are a number of potential benefits to investing in a gold IRA with a gold IRA company, including:

- Tax advantages: Gold held in an IRA grows tax-deferred, which means that you do not have to pay taxes on the capital gains until you withdraw the money from the IRA.

- Diversification: Gold can help to diversify an investment portfolio and reduce overall risk.

- Protection against inflation: Gold has a long history of holding its value during periods of inflation.

- Tangible asset: Gold is a tangible asset that can be held and stored outside of the financial system.

Risks of Investing in a Gold IRA with a Gold IRA Company

There are also a few risks to consider before investing in a gold IRA with a gold IRA company, including:

- Volatility: The price of gold can be volatile, so investors may experience losses in the short term.

- Liquidity: Gold can be less liquid than other investments, such as stocks and bonds. This means that it may be more difficult to sell your gold if you need to.

- Storage costs: There are storage costs associated with holding gold in an IRA.

- Fees: Gold IRA companies typically charge fees for their services. It is important to compare the fees charged by different companies before you choose one.

Tips for Investing in a Gold IRA with a Gold IRA Company

Here are some tips for investing in a gold IRA with a gold IRA company:

- Do your research. Learn as much as you can about gold and the gold IRA industry before you invest.

- Compare different companies. Compare the fees charged by different gold IRA companies before you choose one.

- Start small. You do not need to invest a large amount of money in a gold IRA at once. You can start with a small investment and add to it over time.

- Get advice from a financial advisor. A financial advisor can help you to decide if a gold IRA is right for you and can help you to choose the right company and investment strategy.

Conclusion

Investing in a gold IRA with a gold IRA company can be a good way to diversify an investment portfolio and protect against inflation. However, it is important to be aware of the risks involved before investing in a gold IRA. You should also carefully consider the fees charged by different gold IRA companies before you choose one.

What to think about prior to choosing a gold IRA rollover

What is a gold IRA rollover?

If you have actually been saving for retired life, opportunities are good you have a committed retirement savings account like a 401( k) or IRA. These accounts are simple ways to spend your cash for the future while taking pleasure in some appealing tax obligation motivations. Yet there’s one type of pension you may not be as familiar with: a gold IRA.

Gold IRAs work the like typical and also Roth IRAs, but they likewise permit you to capitalize on the many benefits of gold investing, including diversification, defense from inflation and also steady returns. If you’re seeking to shore up your retired life financial savings, it’s worth taking into consideration rolling over your funds from an existing pension to a gold individual retirement account.

What is a gold IRA rollover?

A 401k to Gold IRA rollover is the transfer of funds from a traditional IRA or 401( k) to a self-directed IRA that enables financial investment in various other rare-earth elements. This means that as opposed to having your retired life financial savings bound in conventional assets like stocks, bonds and mutual funds, you rather diversify your portfolio by including gold as well as various other precious metals such as silver, platinum and also palladium.

You can do a direct rollover, in which the organization holding your present pension transfers funds straight into your brand-new gold IRA. Or, you can do an indirect rollover, in which you take out the funds from your bank account as well as deposit them into the new one on your own.

Straight rollovers are much faster and also are 100% tax obligation- and penalty-free. If you select an indirect rollover, you have 60 days from the moment you receive the funds from your old account to the time you put them right into your new account. If you don’t complete the rollover within these 60 days, the IRS considers it a distribution or withdrawal. You’ll be exhausted on it, and also you’ll also encounter a 10% very early withdrawal charge if you’re under 59 1/2.

Benefits of a gold IRA rollover

One of the main benefits of a gold individual retirement account rollover is the safety gold offers in periods of economic chaos.

Gold has actually long been regarded as a safe house throughout times of monetary situation, as it has a tendency to hold its value (if not increase in value) when the economic situation is unstable. Unlike conventional financial investments, gold and also other precious metals preserve a fairly stable worth in spite of periods of inflation, geopolitical instability and also market volatility.

Additionally, gold is negatively associated with assets like supplies, which implies that its worth has a tendency to rise when these properties go down. This can minimize your danger direct exposure and assist you preserve your retired life cost savings when typical assets are underperforming.

What to think about prior to choosing a gold IRA rollover

Prior to deciding on a gold individual retirement account rollover, ensure you understand any type of costs entailed. Gold IRAs come with charges you might not have with various other pension, including storage space and also insurance fees, custodian costs and the premium you’ll spend for physical gold. See to it to take these right into account, as they will certainly affect your bottom line.

Exactly how to set up a gold IRA rollover

To start a gold individual retirement account rollover, you first require to discover a trustworthy gold individual retirement account custodian to hold your gold assets as well as manage your account. Seek one with a strong track record, fair costs and also a lot of favorable customer feedback.

You will after that deal with the custodian to transfer funds from your existing pension into your brand-new self-directed gold individual retirement account. As soon as the account is established, you can begin dealing gold through this account.

You can select to purchase either gold bars and coins or exchange-traded funds (ETFs) that track the rates of gold. Your individual retirement account custodian will certainly manage all the needed documentation as well as guarantee every little thing is done according to internal revenue service guidelines. They will certainly also save your physical gold in a protected center.

Gold IRA Rollover: Frequently Asked Questions

Can I transfer my 401( k) to a gold individual retirement account?

Yes, you can move your 401( k) to a gold individual retirement account if you’re above 59 1/2 years old. To transform your 401( k) to gold, you will certainly need to choose a gold individual retirement account company, open up an account, submit the required documents, and also initiate a straight transfer from your 401( k) account. By switching over from a traditional account, you acquire extra investment versatility and also can benefit from the potential benefits of gold investing.

Can I put all my 401( k) into gold?

You can’t directly invest your 401( k) funds into gold, however you can relocate your 401( k) funds to a gold individual retirement account via a rollover process. This requires discovering an IRA custodian that concentrates on gold investments as well as finishing the necessary documents.

If you wish to acquire physical gold bars, coins or bullion, you’ll need to open a self-directed gold IRA for your 401( k) pension. Financial investment advisors do not advise putting all your financial savings into one financial investment car, as well as it is generally suggested to put no greater than 5-10% into gold.

The bottom line

A gold individual retirement account is a powerful tool that incorporates the tax benefits of standard pension with the benefits of investing in gold. As well as if you currently have funds in a standard account like a 401(k) or IRA, moving those funds over into a gold individual retirement account is a rather straightforward process.

Naturally, before making any kind of financial investment decision, it is very important to thoroughly consider the pros and cons and also talk to an economic advisor to establish the path that best fits your individual requirements and also objectives. With the right plan in place, a gold individual retirement account rollover can be a beneficial enhancement to your investment method.

A Comprehensive Analysis of Gold IRA Rollover for 2023

Are you considering buying rare-earth elements like gold, silver, platinum eagle and palladium for retired life? If thus, you might would like to consider a gold IRA rollover.

Recently, our company’re observing much more Americans rely on gold and silver as safe-haven investments. This results from any sort of variety of economical problems our team’re currently dealing with including record-breaking inflation, geopolitical turmoil, as well as reckless federal government costs.

If you recognize you desire to diversify your financial investments into gold and silver, but do not understand how to get going, read on.

We’ve consisted of every thing you need to have to know about gold IRAs and also gold IRA roll-overs in this extensive as well as comprehensive manual!

What is actually a Gold IRA?

An IRA is actually an “ira”.

A gold IRA or “metals IRA” is only how we describe an IRA that is actually used to purchase metals. Extra specifically, it’s a self-reliant individual retirement account (SDIRA).

A self-directed IRA enables you the alternative to expand your retirement life in to ‘alternate possessions’ certainly not typically available with traditional retirement.

A gold IRA works the same way as a conventional IRA apart from that it makes use of gold rather than newspaper properties. It is actually one of the best options for someone that wishes to buy gold as well as additionally make use of the tax benefits of an IRA.

What is actually A Gold Ira Rollover?

A gold IRA carry over is when you move your pension to a self-reliant metals IRA that has gold at your opted for depository.

The depository must be actually authorized by the IRS and you can hold other sorts of rare-earth elements as well.

Can You Tell Me About The Costs Associated With A Gold Ira?

When you acquire gold and silvers for your brand new IRA, you’re visiting observe that your expenses are heading to be actually higher than with digital purchases.

This is actually considering that you’re acquiring real precious metals that possess storage charges and also require to become relocated in addition to guaranteed. Unlike buying allotments of a gold fund or an ETF, you really have bodily gold along with a gold IRAs.

You have main possession of the gold you acquire with a gold IRA as well as have to eat the additional expenses of owning true gold.

Nevertheless, you also own a substantial resource rather than a newspaper financial investment so it flattens relying on your tastes.

In the table listed below, you can find a lot of the traditional gold IRA Rollover fees you are going to come across along with your brand-new gold IRA provider:

What About Taxes?

This is due to the fact that you are actually moving your funds in between two qualified, tax-deferred programs.

This also uses when you carry out a gold IRA rollover coming from your 401( k), 403( b), 457 (b) or even TSP (as well as very most other retired life committing profiles).

Gold IRAs likewise work like the majority of various other pension, as well as are tax-advantaged for many deals.

Gold IRA Performance Over Time

Gold IRAs and also gold expenditures have conducted very well over extended periods of time given that the rate of gold has continuously been climbing in time.

Exactly how Perform You Rollover Your Current Retirement Account Into A Precious Metals Ira?

The roll-over method involved with moving your existing retirement account in to a metals IRA is actually different depending upon your current circumstance.

However irrespective of what your current retirement account is, your 1st step is to create a self-directed IRA with a manager that will let you store physical gold and silvers.

Your decided on metals dealership will probably be accredited as well as possess a few protectors for you to select from.

They’ll additionally be most likely to help you accomplish any type of documents that requires to become performed to make sure soft handling, and some – like Augusta Precious Metals – can also waive the charges depending on a number of variables.

Next off, you’ll need to decide which kind of carry over matches your needs.

Straight Rollover Transfers

With a direct carry over, your funds will be immediately moved from your current pension in to your gold IRA.

Your aged pension will definitely at that point be actually shut as well as the supervisor of your aged profile will send your existing total up to your gold IRA’s fiduciary or custodian.

Indirect Rollover Transfers

Along with a secondary carry over, you take your money out of your existing pension yourself, and then money your brand new gold IRA.

It’s crucial to take note that you possess 60 days coming from the time that you acquire funds coming from your old custodian to move the funds to your new self-directed gold IRA protector.

Stopping working to transfer funds within 60 days can lead to substantial tax obligations as well as charges. The IRS may consider it a taxable drawback.

If you’re performing a secondary gold IRA carry over, make sure to move quickly and steer clear of these tax obligations.

Gold IRA Distributions – What You Need To Know

There are several elements to think about when intending a circulation from your gold IRA.

RMD stands for “Required Minimum Distribution”.

It is actually the minimal amount that you need to take out yearly coming from your profile as soon as you reach the grow older of 72. The old age limit was 70.5 years old but it is actually currently 72.

Every pension with the exception of Roths undergo RMDs.

Your custodian will provide you the minimum required amount you require to remove yearly when you attack 72 years of age.

Your custodian calculates your RMD by breaking down the previous year’s account remainder on the 31st December through a distribution time frame from the IRS’s Uniform Lifetime Table.

With gold IRAs, you possess the alternatives of a cash money RMD or even an “in-kind distribution”.

An in-kind circulation within this situation suggests that your precious metals will be actually delivered to you.

If you pick to receive a money RMD, your custodian is going to likely deliver you ACH repayments completely free and also on a timetable that you specify. It varies from manager to protector though.

Choosing The Right Gold IRA Company For You Retirement Plan

if you want to expand your retired life profile with rare-earth elements, you’ll benefit from our extensive guide to the gold IRA company.

From the multitude of companies accessible in the market, we carefully handpicked five, thinking about important aspects such as their credibility, complaint background, customer testimonials, overall customer experience, and connected costs. All these components are essential when selecting a relied on gold IRA business for your rare-earth elements financial investments.

Recognizing what variables to think about when selecting a company to collaborate with and also being aware of both advantages and also risks related to purchasing a gold IRA is critical to your success.

Augusta Precious Metals,

Augusta Precious Metals, developed in 2012, ranks as the most effective gold IRA firm as well as is a prominent choice for rare-earth elements financial investments due to its customer-centric approach as well as huge competence. They offer a broad selection of IRA-approved rare-earth element coins and also bars, dealing with capitalists with varied spending plans and also investment choices.

Concentrating on rare-earth elements IRAs, Augusta is renowned for its convenience of cooperation. If you’re aiming to purchase gold or silver, the firm’s rare-earth elements professionals will help in surrendering your 401( k) and also transferring your IRA to gold, leading you through each action as well as taking care of all the documents for you.

Furnished with in-depth understanding of gold and silver IRAs, Augusta’s client service agents make it possible for customers to expand their retired life profiles with different types of precious metal assets if preferred.

Goldco

Goldco is a reliable gold IRA firm and an exceptional selection for those seeking to expand their retirement portfolios with rare-earth elements. It flaunts a total consumer fulfillment ranking of 4.9/ 5 and an A+ ranking from the BBB, grounded in the positive feedback obtained from TrustPilot individuals.

Like Augusta Precious Metals, Goldco focuses on gold and silver products, using gold bars, silver coins, and also various other IRA-eligible rare-earth elements. All precious metals are offered for straight purchase. Buyback warranties and also competitive prices give financiers the comfort that they can liquidate their assets with Goldco’s help when essential.

American Hartford Gold is just one of the best precious metals IRA companies and also reliable gold dealers in the U.S. The firm’s dedication to customer success has amassed an impressive overall score of 4.7 out of 5 on Consumer Affairs, together with many positive client testimonials on platforms like TrustPilot as well as Google Reviews. Holding an A+ rating from the Better Business Bureau because 2016, the company has actually received extremely few minor issues because the beginning of 2023.

American Hartford Gold is renowned for its reduced costs, supplying potential investors with whatever needed for effective financial investments. This includes a complimentary guide on purchasing gold IRAs as well as 3 straightforward actions to convenient account opening.

The company makes certain secure financial investment options with prominent physical precious metals – a confidence many look for throughout financial instability. They likewise offer financial planning solutions to ensure your financial investment technique lines up with your long-term objectives.

Things to Consider When Choosing Precious Metal IRAs

Before delving right into gold IRA investing, it’s important to take into consideration various facets when choosing a company to deal with. In the complying with area, we’ll check out the relevance of dependability and dependability, charge framework as well as transparency, client service as well as assistance, as well as the choice and also quality of rare-earth elements.

Understanding these elements will allow you to make a notified decision when choosing a precious metals IRA business. As a result, think about the reputation of your prospective service provider along with the gold IRA fees they charge per purchase.

Ensure that they supply full transparency on prices, have top-notch client assistance conveniently available to supply the required advice, as well as provide a variety of high-grade metals at reasonable rates.

Gold IRA Reviews

The reputation and also reputation of a gold-backed IRA business are necessary for financiers to ensure a positive experience. Variables such as sector rankings, years in operation, and also consumer reviews ought to be thought about when evaluating a business’s reliability and also reliability. A trusted company would certainly give even more reliable services, making it a more effective choice for buying your rare-earth elements IRA account.

Referencing the Better Business Bureau’s (BBB) ratings, which vary from A+ to F, can be practical when analyzing the online reputations of different gold IRA firms. All the rare-earth elements IRA business on our checklist received the highest possible A+ rating from the BBB, symbolizing their commitment to excellence.

Moreover, favorable client responses and go crazy gold IRA business reviews indicate that these organizations’ commitment to offering exceptional assistance and also service high quality.

In addition to the above factors to consider, talking to an independent monetary consultant is crucial. This advice will certainly enable you to make sensible options when picking the right gold IRA organization, guaranteeing your resources are invested firmly for long-term future growth.

The Benefits of Gold IRA Investment

Gold individual retirement accounts provide security, tax obligation advantages, as well as the opportunity to branch out retirement funds. Gold is an excellent hedge versus rising cost of living, making it a strong option when intending finances for retirement.

Gold IRA Rollover Process

When planning to shift from an existing retirement account, such as a 401(k), 403(b), TSP, or Roth IRA, right into a gold IRA represent included stability and diversification in your retired life profile, picking the appropriate gold IRA firm is essential.

To launch the rollover process, you have to notify your existing retirement account administrator that you intend to move your funds to a self-directed IRA. Your picked gold or silver IRA firm will aid you with all the called for paperwork to facilitate the transfer.

Story

Browsing the Globe of Gold IRAs: A Comprehensive Guide to Transforming Your IRA to Gold

In recent times, gold has emerged as a compelling investment choice for individuals seeking to secure their retirement cost savings from inflation and economic instability. Gold IRAs, or Person Retirement Accounts that allow you to purchase physical gold, have actually obtained considerable popularity as a means to branch out portfolios and hedge versus market volatility.

The attraction of gold Individual retirement accounts

Gold IRAs provide a distinct opportunity to incorporate tangible assets into your retirement cost savings method. Unlike conventional IRAs that mainly buy supplies, bonds, and various other monetary instruments, gold IRAs give a straight exposure to the precious metal, possibly protecting your portfolio from the changes of the standard monetary markets.

Advantages of transforming your IRA to gold

Rising cost of living bush: Gold has traditionally demonstrated a positive correlation with rising cost of living, implying its value has a tendency to increase as the price of living increases. This characteristic makes gold an appealing investment for people looking for to protect their buying power from the disintegration of rising cost of living.

Diversity: Incorporating gold right into your investment profile can help to lower overall risk by presenting an asset course that is less correlated with traditional financial investments like supplies and bonds. This diversification can potentially enhance profile stability and alleviate the impact of market downturns.

gold ira Concrete possession: Unlike stocks and bonds, which are essentially economic cases on business or federal governments, gold is a physical property that exists individually of the monetary system. This tangibility gives a sense of security and stability, particularly in times of financial unpredictability or market volatility.

Risks to consider

Volatility: Gold prices are subject to variations, and there is no assurance of returns or security from losses. Investors must be prepared for prospective price swings and must not watch gold as a assured course to wide range accumulation.

Liquidity: Contrasted to stocks and bonds, gold is less liquid, suggesting it may take longer to sell your gold and receive your cash. This absence of liquidity must be thought about when figuring out the suitability of gold for your investment method.

Storage costs: Storing physical gold safely includes costs connected with risk-free deposit boxes or specialized storage space centers. These storage space costs can affect your general returns and should be factored into your investment choice.

Actions to convert your IRA to gold

Pick a reliable gold IRA custodian: Completely research and choose a reputable gold IRA custodian that is registered with the internal revenue service and has a proven record.

Open a gold IRA account: Total the essential documents and develop a gold IRA account with the picked custodian.

Fund your gold IRA: You can money your gold individual retirement account by surrendering funds from an existing individual retirement account or by making new payments.

Acquisition gold: Once the funds are readily available in your gold IRA, you can begin purchasing gold via your custodian. They will certainly lead you with the procedure of choosing proper gold investments.

Shop your gold: Determine whether to store your gold securely with your custodian or arrange for third-party storage space.

Additional factors to consider

Charges: Thoroughly testimonial and compare costs charged by different gold IRA custodians, consisting of account arrangement fees, yearly upkeep fees, and purchase fees.

Financial investment alternatives: Explore the variety of gold financial investment choices used by potential custodians, guaranteeing it lines up with your investment preferences and run the risk of resistance.

Tax obligation ramifications: Consult with a tax obligation expert to recognize the tax obligation effects of converting your IRA to gold, particularly if you are taking into consideration withdrawing funds prior to getting to old age.

Financial advisor: Look for advice from a financial advisor who focuses on gold Individual retirement accounts to get tailored guidance tailored to your particular financial circumstance and investment purposes.

Added Tips for Converting Your IRA to Gold

Start Small: Start by converting a small portion of your individual retirement account to gold, permitting you to observe the performance and examine your comfort degree before dedicating a bigger amount.

Expand Your Profile: Maintain a diversified profile by investing in a selection of property classes, consisting of supplies, bonds, property, and gold. This diversification can assist to handle threat and potentially enhance overall returns.

Rebalance Routinely: Occasionally evaluate your portfolio allotment and rebalance as required to maintain your desired asset course distribution. This procedure ensures that your portfolio remains aligned with your financial investment objectives and risk tolerance as your economic scenarios and market problems progress.

Seek Professional Assistance: Seek advice from a economic consultant that specializes in gold Individual retirement accounts to gain personalized suggestions tailored to your certain monetary scenario and financial investment objectives. They can aid you browse the complexities of gold Individual retirement accounts and make educated decisions that align with your total monetary strategy.

Frequently Asked Questions ( Frequently Asked Questions).

What are the expenses connected with gold IRAs?

The prices of gold IRAs differ depending upon the custodian you select. Generally, you will incur account arrangement fees, annual maintenance costs, and purchase fees. It is important to compare fees from various custodians to discover one of the most cost-efficient choice.

What are the tax implications of transforming my IRA to gold?

Rolling over funds from an existing IRA to a gold IRA is normally tax-free. Nevertheless, if you withdraw funds from your gold IRA prior to getting to retirement age, you may be subject to revenue tax obligation and a 10% very early withdrawal fine. There are exceptions to this policy, such as if you are making use of the cash for certain qualified expenditures, such as education and learning or clinical costs.

Just how can I guarantee the secure storage space of my gold?

There are two key options for saving your gold:.

a. Custodian Storage space: Lots of gold IRA custodians provide safe storage centers for your gold. This choice supplies comfort and peace of mind, as your gold is guaranteed and safeguarded from burglary or loss.

b. Third-Party Storage space: You can likewise select to store your gold in a third-party safe or risk-free deposit box. This choice uses higher control over your gold, yet it also increases your obligation for ensuring its safety and security and safety and security.

What are the benefits and drawbacks of self-directed IRAs?